are political contributions tax deductible for corporations

Its Written Into the Tax Code The Internal Revenue Service IRS also specifically says. All four states have.

Is Your Political Donation Tax Deductible Wsj

This form itemizes your taxes to understand better what is or is not.

. The Taxpayer First Act Pub. There are five types of deductions for. To a state local or district party.

Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in federal state and local elections and to contribute to the campaign funds of the candidate or party of their choice are deductible by the taxpayer under section 162 a of the internal revenue code of 1954. Regardless of whether a political contribution is made in the form of. The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations.

Tax-deductible rules also state that expenses incurred while volunteering for a political campaign or organization cannot. The IRS guidelines also go beyond just direct political contributions. Qualified contributions are not subject to this limitation.

And if you check the box when filling out. 10000 combined To a national party. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. Political contributions arent tax deductible. Businesses cannot deduct contributions they make to political candidates and parties or expenses related to political campaigns.

Are political donations deductible 2020. Businesses that incur political expenses need to have. Are Political Contributions Tax Deductible For Corporations.

Some contributions can be made to the educational arm of a political organization when those arms are qualified under. Posted on Jul 26 2009 Usually theyre not deductible. A tax deduction allows a person to reduce their income as a result of certain expenses.

Any contributions gifts or payments made to political organizations are not considered tax-deductible as stated by the Internal Revenue Service which maintains specific. You can only claim deductions for contributions made to qualifying organizations. You are to itemize your taxes on form 1040 Schedule A.

These taxes should be documented and kept for future reference. However the IRS does not allow contributions to any politician or political party to count as a. The irs states you cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund.

These taxes should be documented and kept for future reference. The amount of the deduction for a contribution or gift of property is either the market value of the property on the day the contribution or gift was made or the amount. The agency also bans businesses.

For amounts over 750 33 will be charged.

New York State Young Democrats Join Senate Majority Leader Andrea Stewart Cousins Nys Democratic Senate Campaign Committee Dscc Chair Mike Gianaris And The Nys Senate Super Majority For A Virtual Summer Reception Tonight

Are Campaign Contributions Tax Deductible

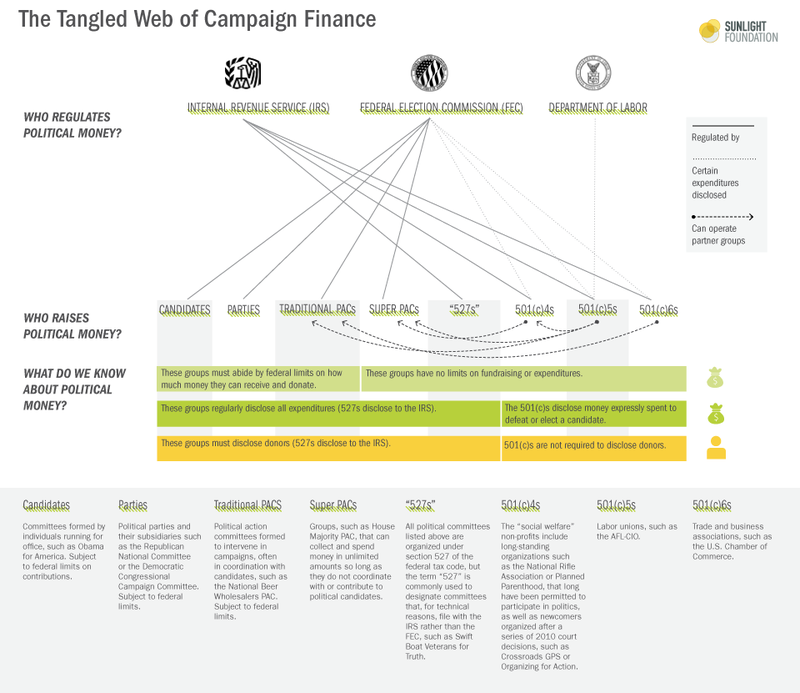

Campaign Finance In The United States Wikipedia

Why Political Contributions Are Not Tax Deductible

Why Political Contributions Are Not Tax Deductible

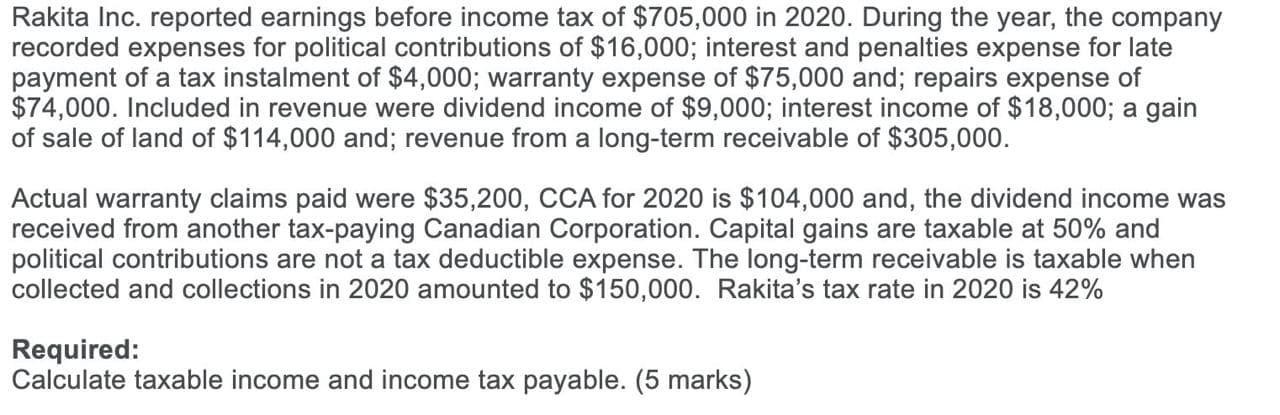

Solved Rakita Inc Reported Earnings Before Income Tax Of Chegg Com

Why Political Contributions Are Not Tax Deductible

Are Political Donations Tax Deductible Picnic Tax

Are Political Contributions Tax Deductible Smartasset

Solved 27 000 Question 53 Which Of The Following Statements Chegg Com

Are Political Contributions Tax Deductible H R Block

Are Corporations Claiming Tax Breaks For Super Pac Donations The Atlantic

Campaign Finance In The United States Wikipedia

:max_bytes(150000):strip_icc()/hard-money-soft-money_final-0223d3d452a049dc95a8a05b20c9142a.png)

Hard Money Vs Soft Money What S The Difference

Ending Foreign Influenced Corporate Spending In U S Elections Center For American Progress

Are Political Contributions Tax Deductible Tax Breaks Explained

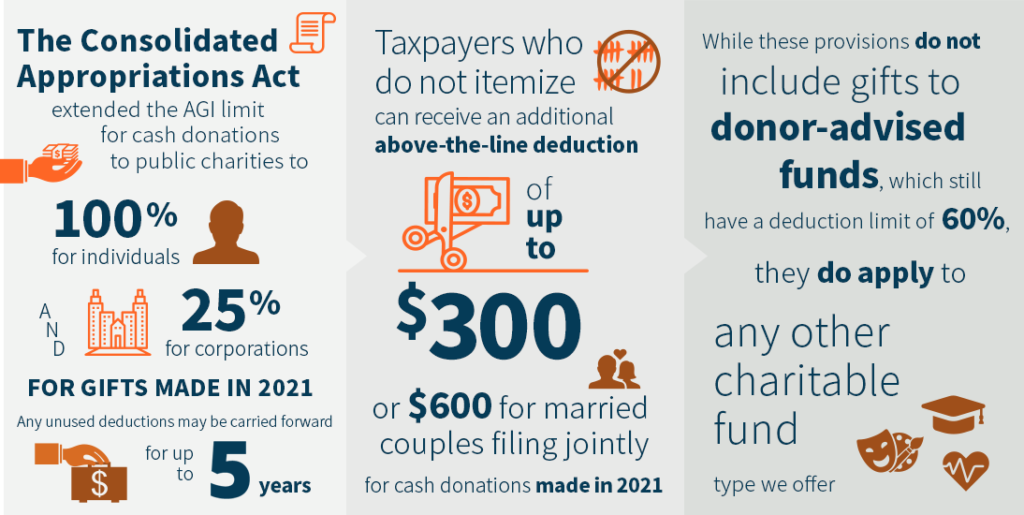

Congress Extends Charitable Giving Incentives For 2021 Akron Community Foundation