tax abatement definition for dummies

Tax abatement analysis fiscal and economic are complex and rely on existing relationships to measure change. Abatement Definition You may wonder just what the one-time Tax Penalty Abatement program entails.

The government can fund a project by pointing to the revenue the project will generate once its complete.

. The owner pays property tax and the political subdivision uses the payments as provided by the abatement resolution. The word abate means to reduce in value or amount So a tax abatement is simply a lessening of tax. Tax abatement synonyms tax abatement pronunciation tax abatement translation English dictionary definition of tax abatement.

What Does Tax Abatement Mean. Abatement as a percentage of tax payable a dollar amount the tax attributable to a portion of the parcels market value or something else. Check out our property tax calculator.

More from HR Block. A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement. In certain situations they will even go as far as to revoke the extra.

For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. A penalty or tax abatement can be defined as forgiveness of the penalties associated with tax debt that have been added on by the IRS over the course of the debt. It is offered by entities that impose taxes on property owners.

A sales tax holiday is another instance of tax abatement. Sometimes the IRS will agree to remove some of the penalties that were assessed. Tax Increment Financing aka Tax Allocation Districts Tax Increment Reinvestment Zones etc.

One method is called tax increment financing. A tax abatement is a financial incentive that eliminates or significantly reduces the amount of taxes that an owner pays on a piece of residential or commercial property. IRS Definition of IRS Penalty Abatement.

An abatement cost is a cost borne by firms when they are required to remove andor reduce undesirable nuisances or negative byproducts created during production. The local government adds the abatement to its property tax levy. Calling this tax abatement means that for example a.

However for sales and use tax purposes only those purchases made after the abatement is granted will qualify for the tax abatement. A reduction of taxes for a certain period or in exchange for conducting a certain task. Tax abatement n Steuernachlass m.

Applied to property tax savings resulting in practice when a local authority leases a project to a company. Tax abatement noun C or U TAX FINANCE PROPERTY uk us a reduction in the amount of tax that a business would normally have to pay in a particular situation for example to encourage investment. To increase savings or spending rate invest in equipment or others.

This chapter will cover the tax rules that impose some. In essence this program is a reprieve that allows you to escape the penalties levied against you because of not filing or failing to pay your taxes. Who Receives a Tax Abatement.

Essentially it means banking on the increase in property tax revenue that will result when the project is finished. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm. These entities can include.

An abatement applies to all real and personal property incorporated into the project. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control. TIF is particularly useful to communities where local leaders envision a resurgence of population a robust local economy and a town capable of providing the varied public services security and quality of.

The development is eligible for a 10-year property tax abatement. Without tax abatement I will never get the loans to finance the project. A tax abatement credit is generally given to a firm when the government wants the saved money to be spent in another way.

A city grants a tax abatement to a developer. The savings in that case results from the difference in the taxability or valuation of the lease. Tax Increment Financing TIF is a means by which cities towns and villages may achieve a level of community and economic development far beyond current expectations.

Penalty abatement removal is available for certain penalties under certain circumstances. When discussing impact analysis both fiscal and economic it is important to understand terms like direct indirect and induced impact. Municipalities City governments State treasury offices The federal government.

The benefits of the tax abatement are then passed on to owners or renters who eventually purchase or rent property within the building. An amount by which a tax is reduced. A primary goal of tax management is to avoid wide fluctuations in annual income in order to avoid swings in marginal tax rates.

Farmers who use cash-basis accounting can manage their tax liability by shifting income away from the high-income years and deductions away from low-income years. TIF allows local governments to invest in infrastructure and other improvements and pay for them by capturing the increase in property taxes and in some states other types of incremental taxes generated by the development. Definition of tax abatement.

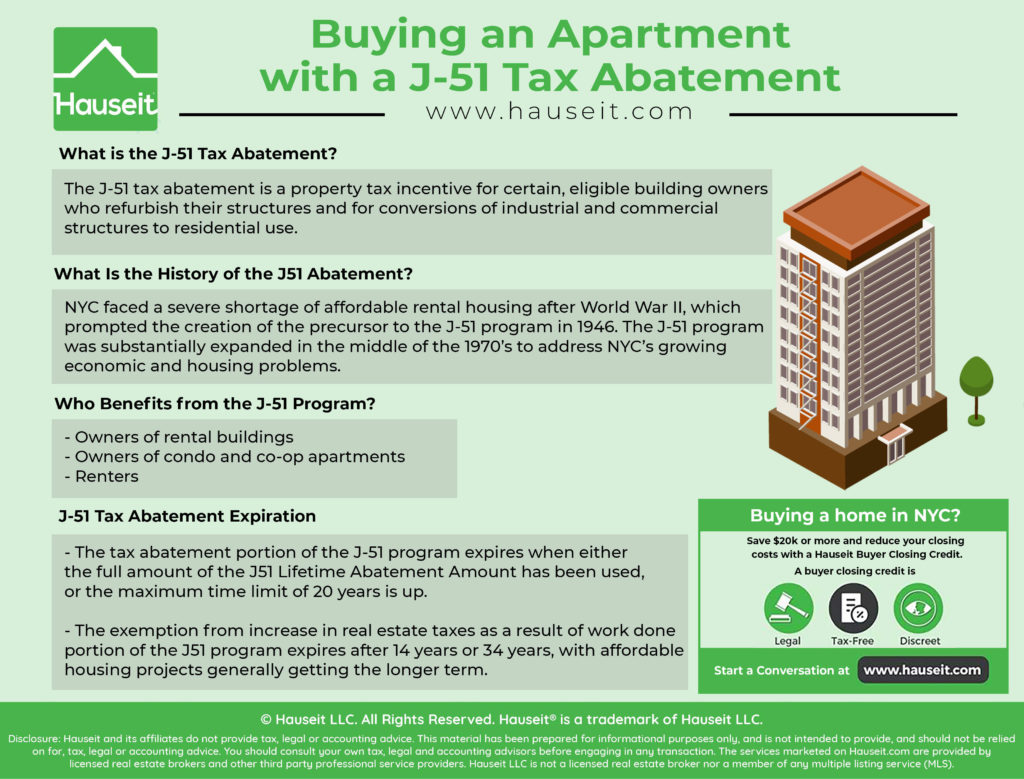

Buying An Apartment With A J 51 Tax Abatement Hauseit

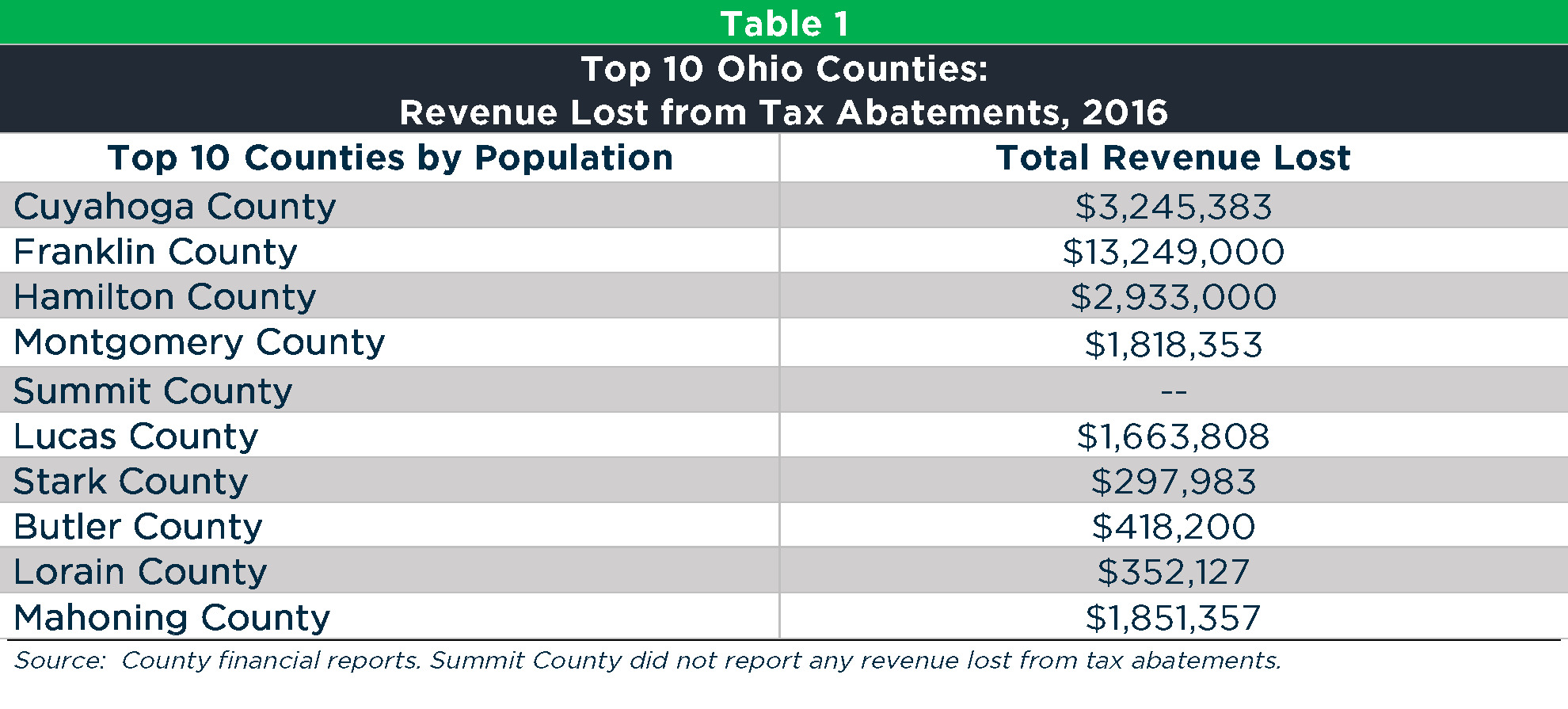

Local Tax Abatement In Ohio A Flash Of Transparency

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

The Sutton White Box Duplex Penthouse Sutton Place Condos House Floor Plans Pent House Luxury Condo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Insurance Policy Binder 17 Ideas To Organize Your Own Insurance Policy Binder Binder Templates Life Insurance Policy Templates

Top Rated Tax Resolution Firm Tax Help Polston Tax

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Local Tax Abatement In Ohio A Flash Of Transparency

.png)

Property Tax Abatement Program

Employee Retention Tax Credit Office Of Economic And Workforce Development

The Difference Between Tax Abatements And Tax Exemptions Propertyshark Real Estate Blog

What Is The 421g Tax Abatement In Nyc Hauseit

What Is The Nyc Senior Citizen Homeowners Exemption Sche

Understanding California S Property Taxes

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo